This article originally appeared in Digital Wealth News’ MarTech Minutes.

Wealth firms are increasingly confronting an array of challenges.

One of the most perplexing and persistent is managing marketing communication policy gaps. Digital Wealth News recently interviewed Teresa Leno, CEO and Founder of Fresh Finance, an enterprise marketing communications solution for the wealth, banking, and insurance industries. Leno offers insights into marketing communications with the public, a topic impacting many firms today.

Unfortunately, many firms today face serious communication policy gaps. These gaps may emanate from a firm’s unclear communication with the public guidelines, an inadequate communication infrastructure, vendor error, or the lack of technologies to house, approve, store, monitor, and provide advisors with compliant content.

Marketing communications policies provide an outline or blueprint that guides all elements of communication within an organization. Communication policies must encompass various aspects, including modes of communication, communication objectives, technology, approval of financial content, and much more.

Most importantly, the policy must also define advisors’ client and prospect interaction protocols, which FINRA considers marketing communications with the public, a critical aspect of wealth management compliance operations. These policies must go beyond archiving, compliance approval, or social media monitoring solutions; an enterprise marketing communications platform must be central to the communication policy’s success.

“Wealth management firms must consider the implications of their marketing communications policy. They should view it not just as a precondition for firm-client engagement but as an expectation- everything must follow the policy. Furthermore, firms must understand that communication is essential in disseminating information, creating advisor-client trust, and nurturing long-lasting client relationships.

Aside from policy, these firms must utilize technology to address any gaps that could harm client relations and, ultimately, the bottom line. Central to the policy is licensing technology to create, store, and distribute compliance-approved content while making it accessible to all stakeholders,” says Leno.

Today’s clients live in a fast-paced digital world marked by a pervasive culture of immediacy, where accurate, helpful finance information is disseminated in real time, and misinformation can be costly. While many wealth management firms have adapted to these client demands admirably, some still need help to bridge the gap regarding compliant content and marketing communications technology, comments Leno.

Digital tools and platforms designed for regulated industries like the wealth, banking, and insurance industries can vastly enhance how wealth management firms communicate with their clients. But to be effective, they must be solutions that are managed at the enterprise level and provide access to all stakeholders- marketing, compliance, and advisors.

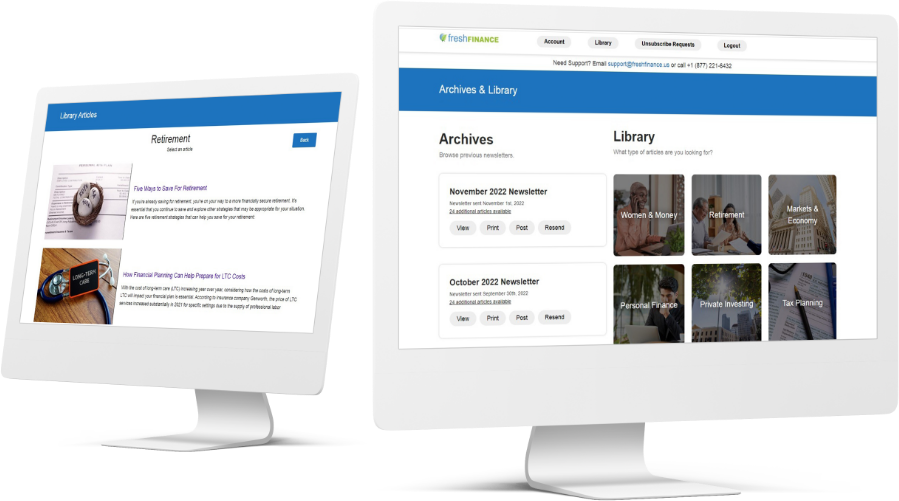

“Enterprise communication technology like Fresh Finance can help ensure the right messages are shared with specific clients at the right time. Our tools enable advisors to customize their newsletter headers or share content on social media or blogs based on their preferences, thus enhancing the user’s (advisor’s) experience.

Firms must seek enterprise solutions to be managed at the firm level to benefit their advisors, such as email marketing, social media, and compliant content for them to use as they desire. This way, the firm provides advisors with the approved content and communication tools they need to grow relationships and attract new business,” says Leno.

Leno explains that while advisors can independently select multiple tools from various tech providers, the firm’s marketing and compliance teams don’t manage them or always know what’s happening. These providers do not always provide compliant content through their technology platforms, for example, a website blog. There is a difference between FINRA-reviewed, which doesn’t mean approved at the firm level, and firm-reviewed and approved, which means the advisor can use the content without fear of fines because their compliance department has approved it.

Indeed, finding effective ways to plug communication policy gaps is a complex task. It requires substantial commitment from management, time, resources, and often a cultural shift within the organization. However, what is clear is that the industry’s future competitiveness hinges on wealth management firms conceiving and implementing client-centered communication policies and marketing communications technology.

Lastly, these efforts for a viable client communication policy depend on continuous vigilance and adjustment. As client expectations, regulatory landscapes, and communication technologies evolve, wealth management firms must regularly review and adapt their communication policies and technology accordingly.

In conclusion, as we navigate through a rapidly transforming marketing communications landscape, it’s clear that policy gaps must be a top concern for firms. The firms that will emerge as leaders in this new era recognize the problem at hand, develop solid marketing communications policies, leverage robust marketing communications technology, and work toward meeting the expectations of their advisors and, ultimately, clients.